Streamline Your Midstream Accounting: Flexible Outsourcing Solutions

Trilogy Energy Solutions offers expert accounting solutions for midstream companies, leveraging decades of experience and innovative technology to streamline processes, ensure compliance, and drive operational excellence in the dynamic energy sector.

Request a quote

Our Midstream Accounting Services

Plant & Production Accounting

- Plant Balancing

- Gas Plant Processing

- Daily Production Accounting

Reporting & Forecasting

- Complete Reporting, Forecasting

- Monthly Operational Reporting

- Quarterly & Annual Reporting

- Production & Operational Reporting

Financial Management

- Gross Margin Analysis

- Imbalance Management & Accounting

- Revenue Distribution

- Subledger Accounting

Compliance & Regulatory Reporting

- Federal, State, & Regulatory Reporting

- SOC & SOX Management

Settlements & Balancing

- Settlements

- Gas Balancing

Data & Systems Management

- Master Data Setup & Maintenance

- Inventory Management

- Nominations & Allocations

Benefits of Outsourcing vs. Doing It Inhouse

Higher Costs

Requires ongoing investments.

Limited Expertise

Faces limitations in expertise, requiring costly training and struggling to keep pace with evolving industry regulations and technologies.

Scalability Challenges

In-house teams struggle with rigid structures, longer adaptation times, and higher costs when scaling up or down in response to market changes.

Technology Investment

In-house teams face significant upfront and ongoing technology costs, potential obsolescence, and complex implementation challenges.

Operational Burden

In-house accounting teams consume significant management time, diverting focus from critical revenue-generating operations and strategic growth initiatives.

Cost Efficiency

Cuts costs by eliminating expenses for full-time staff, benefits, training, software, and infrastructure.

Access to Expertise

Provides immediate access to specialized midstream accounting experts with deep industry knowledge and advanced skills.

Scalability

Enables rapid, flexible scaling of accounting resources to match business fluctuations, without the overhead of hiring, training, and managing in-house staff.

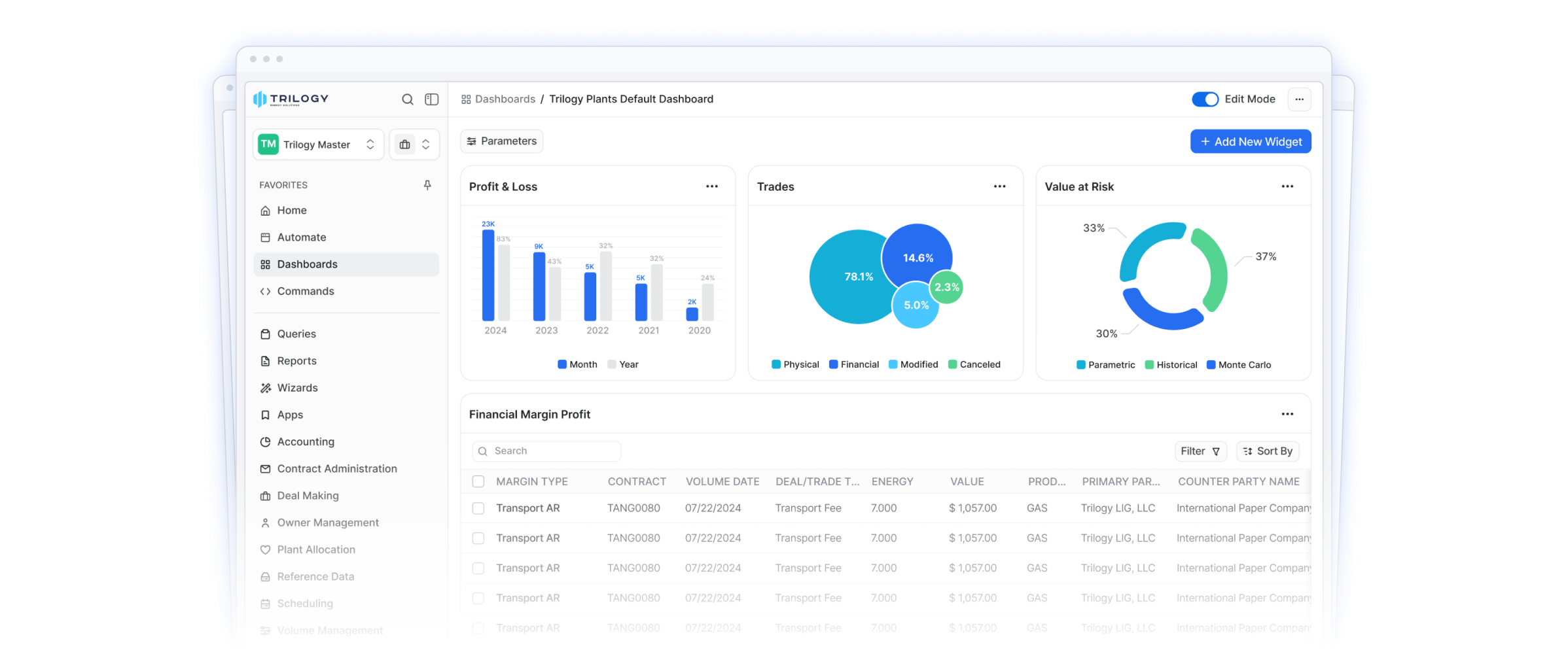

Technology Advantage

Outsourcing provides cutting-edge accounting technologies and platforms without direct investment, leveraging expert providers' advanced systems and continuous technological upgrades.

Focus on Core Business

Outsourcing allows companies to redirect internal resources and energy toward strategic core business activities.

What types of companies can benefit from Trilogy Energy Solutions’ Professional Back Office Accounting Services?

Our services are designed for companies in the midstream energy sector, including natural gas processors, pipeline operators, and energy producers. Whether you need support with daily accounting, regulatory reporting, or complex gas balancing, we tailor our solutions to meet the specific needs of your business.

How does outsourcing midstream accounting compare to doing it in-house?

Outsourcing to Trilogy provides several key advantages:

- Cost Savings: Avoid the significant expenses of hiring and maintaining an in-house accounting team.

- Scalability: Easily scale resources based on your business needs without the hassle of onboarding new staff.

- Expertise: Gain access to our team of specialists with deep knowledge of midstream accounting practices and regulations.

- Technology: Leverage our advanced systems without the need for costly software investments.

How do you ensure regulatory compliance?

We stay up to date on all relevant regulations, including federal, state, and industry-specific requirements. Our team manages your reporting, ensuring SOC & SOX compliance while keeping your business on track with ever-changing regulations.

What is the onboarding process like?

Our onboarding process is seamless and efficient. We begin by assessing your current accounting processes, identifying areas for improvement, and then implementing a customized solution. We’ll work closely with your team to ensure a smooth transition and minimal disruption to your operations.

Can Trilogy Energy Solutions handle the specific complexities of gas balancing and gas plant accounting?

Yes, we specialize in handling complex midstream accounting tasks, including gas balancing, plant balancing, and daily production accounting. Our team ensures accurate, timely processing of these intricate operations, helping you avoid costly errors and inefficiencies.

What makes Trilogy Energy Solutions different from other accounting service providers?

We combine industry expertise, advanced technology, and a client-centric approach. Unlike others, we offer a tailored, fully managed solution that adapts to the specific needs of midstream companies. Our deep knowledge of the energy sector ensures that we not only meet your accounting needs but also enhance operational efficiency.

Ready to get started?

Contact one of our experts to set up a product demo.