TIES ETRM System

TIES ETRM is a cloud-based platform, energy trading and risk management solution designed to optimize strategies and manage risks. Whether you are an experienced trader or new to the field, our platform empowers you to effectively manage risks, balance supply and demand, and optimize operations confidently.

Trusted by producers, pipelines, and marketers worldwide

Leverage the Versatility

of TIES ETRM Systems

Get the benefits with TIES ETRM – your cloud-based Energy Trading Risk Management platform that revolutionizes your midstream energy company’s management!

As a centralized platform with advanced features and adaptability, the TIES ETMS will empower you with tools and the agility to navigate complex markets efficiently. Whether facilitating trades, automating tasks, or delivering real-time insights, you can make informed decisions and effectively use opportunities to achieve sustainable success.

TIES ETRM Solutions:

Trading & Risk

Energy Trade & Risk Management

- Simplify netback pricing

- Capture volume allocation at first flow

- Forecast equity volumes, trade and schedule in a single view

- Eliminate manual processes in maintaining volume pipeline pricing

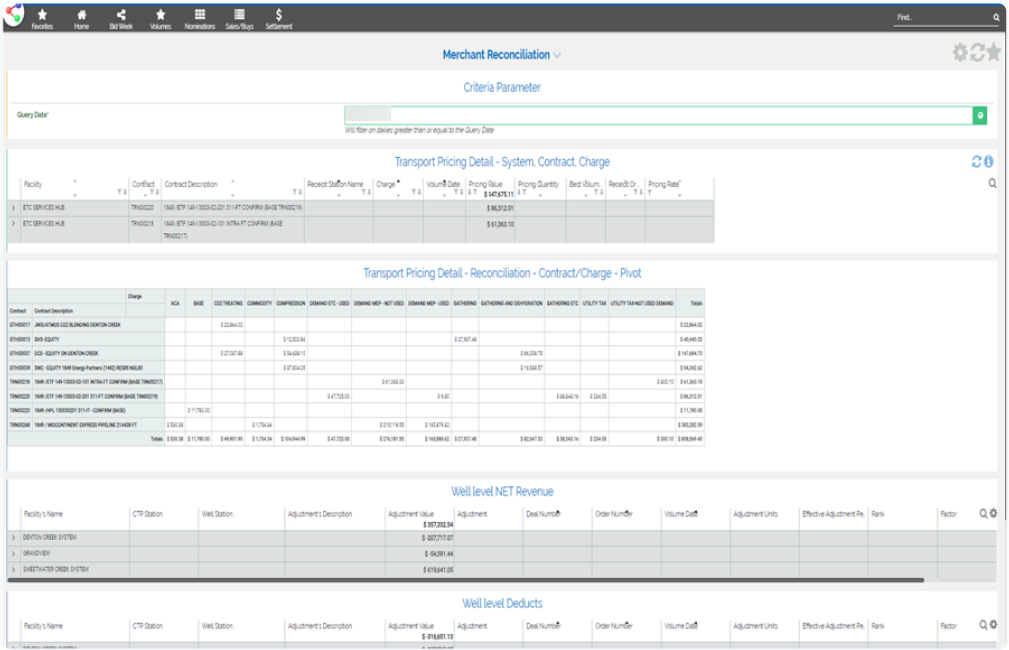

Midstream Marketing

TIES for Transaction Management

- Simplifies the management of pipeline and gathering transactions

- Easily manage contracts, nominations, and scheduling

- Ensures accurate tracking, allocation, and invoicing

- Reduce manual errors

Reporting & APIs

Contract Driven Accounting

- Supports multiple contract allocations

- Keep whole

- Fixed fee

- Percent of product and percent of proceeds

- Fixed recovery

Why Choose TIES ETRM?

Who We Serve?

Many companies in the Energy Industry trust The Integrated Energy Systems ETRM to enhance their trading capabilities and achieve sustainable growth

Gatherers

Supports pathed and non-pathed nomination models.

Pipeline & Storage Operators

Contract management, nomination management, curtailments and more

Plant Processors

Supports the scheduling and sale of all resultant products.

Marketers & Traders

Full range of trading physical energy products and Risk Modules.

FAQs

What does ETRM mean?

Who uses an ETRM?

(ETRM) systems are powerful tools used by energy companies, natural gas and crude oil producers, gatherers, commodity trading firms, pipeline & storage operators, plant processors, marketers & traders, and other market participants who buy, sell, or manage energy commodities and derivatives. These systems provide a robust framework for managing risks and optimizing trading strategies, instilling confidence in market participants.